Artist Financial Management for a Sustainable Career

- enis_sefa

- Oct 14

- 18 min read

Let's be honest, the term "financial management" probably doesn't get your creative juices flowing. For most artists, it sounds like a chore—a boring distraction from what you really want to be doing in the studio or on stage.

But what if I told you that getting a handle on your money is one of the most powerful creative tools you have? This isn't about becoming a stuffy accountant. It's about killing the "starving artist" myth for good by treating your passion like the business it is. It's about making sure your art can actually support you.

Why Financial Management Is Your Most Important Creative Tool

Think of your artistic career like a ship on a long voyage. Your passion and talent are the ship itself, but smart financial habits? That's your map and compass. Without them, you're just drifting, hoping you don't run into a storm. With them, you can navigate with confidence, avoid the rocks, and sail toward bigger, more exciting destinations.

Good financial management is what gives you the stability to take those creative risks that define a career. It lets you fund that ambitious project you've been dreaming of and build something that lasts.

The Power of Financial Stability

Nothing kills creativity faster than money stress. When you're constantly worried about next month's rent, it’s almost impossible to get into that deep, focused state where the magic happens.

Mastering your money isn't about crunching numbers on a spreadsheet; it's about buying yourself creative freedom.

This is the freedom to say "no" to gigs that don't feel right and a big, enthusiastic "yes" to the opportunities that actually excite you. It’s about being in the driver's seat of your own career.

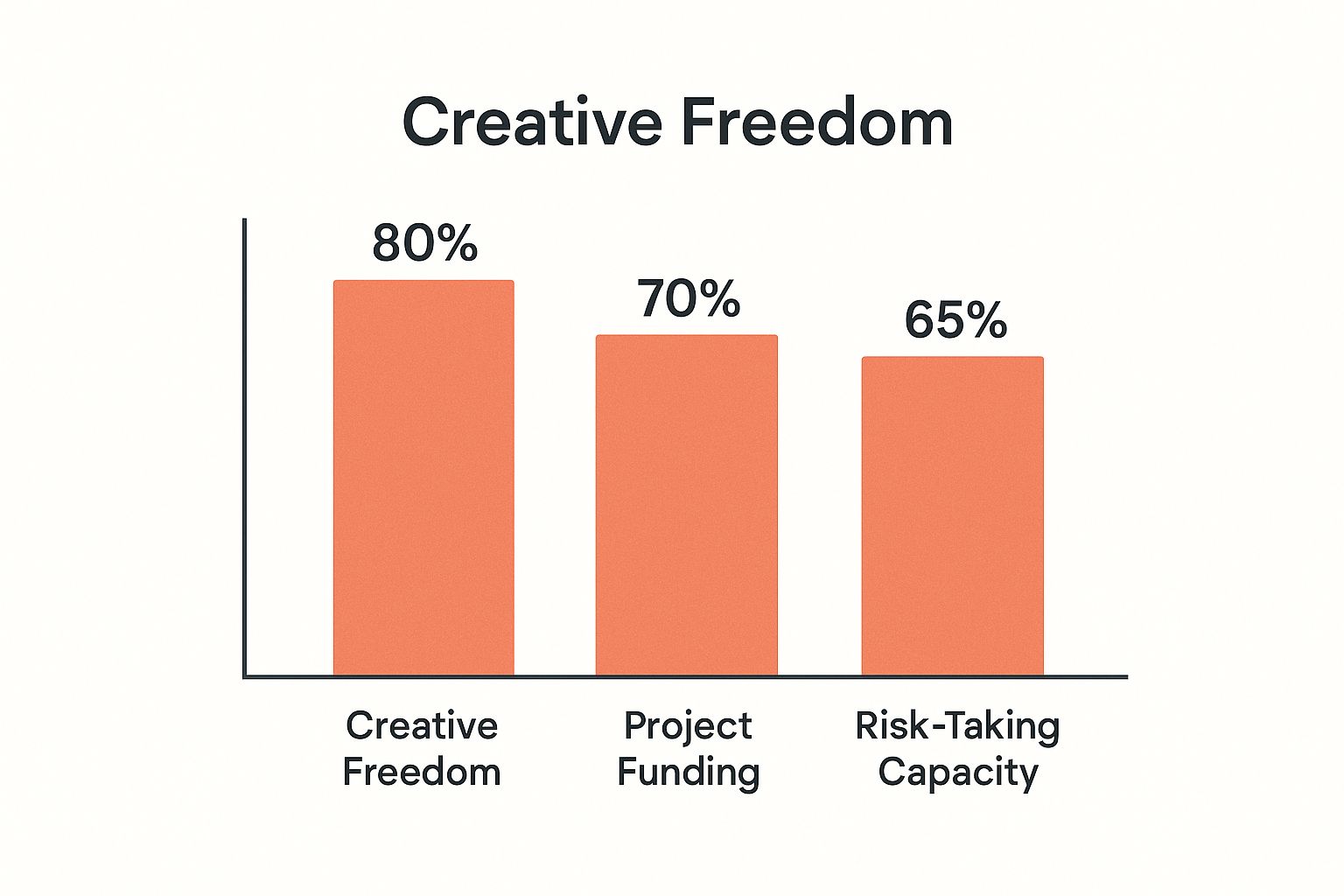

This isn't just a nice idea—it has a real, measurable impact on an artist's ability to create and grow.

The numbers don't lie. When artists feel financially secure, they are way more likely to bet on themselves, invest in bigger projects, and make the kind of bold moves that get them noticed.

Seizing the Opportunity in a Growing Market

There has never been a better time to be an independent artist. The market is blowing up, projected to hit a value of around $104.61 million in 2025 and keep climbing. Thanks to the digital shift, artists have more power than ever to connect directly with fans and build their own income streams. You can dig into the full breakdown over at Market Report Analytics.

This is a massive opportunity, but you have to be ready for it. To really make the most of this new landscape, you’ve got to know how to handle an income that might swing wildly from one month to the next and how to smartly invest back into your own growth.

Building Your Financial Foundation with Diverse Revenue Streams

As an artist, putting all your financial eggs in one basket is a recipe for disaster. Relying on a single income stream is like building a house with only one support beam—it's just too risky. True artist financial management starts with diversification.

It's about creating a web of different income sources. That way, if one area slows down, you have others to keep you steady and moving forward.

Think of your main art sales—your big paintings or major commissions—as the trunk of a tree. It’s the core of your business, for sure. But to build a career that lasts, you need to grow branches that bring in different, smaller streams of cash.

These branches don't just add stability during the slow months. They also open up new ways to connect with your audience and express yourself creatively.

Moving Beyond the Single Sale Model

The old-school model of selling one unique piece at a time is great, but let's be real—it's unpredictable. To create a more consistent cash flow, smart artists layer their income with a mix of active and passive revenue streams.

This approach turns your finances from a wild rollercoaster ride into something you can actually manage and predict.

Here’s a quick breakdown of how these pieces fit together:

Primary Sales: These are your big-ticket items—original paintings, sculptures, or that huge commission. They bring in large sums of money, but they don't happen every day.

Secondary Sales: This is where things like limited-edition prints, artist proofs, or smaller original studies come in. They make your work accessible to a much wider audience at a lower price.

Passive Income: This is the dream, right? Money earned with minimal ongoing effort. We're talking about licensing your art for merch, selling digital tutorials, or collecting royalties.

Service-Based Income: This involves trading your time and skills for money. Think teaching workshops, offering one-on-one mentoring, or doing speaking gigs.

By blending these different types of income, you build a financial ecosystem that can handle the natural ups and downs of a creative career. It’s about working smarter, not just harder, to build something that lasts.

To help you visualize where to focus your energy, let's compare some of the most common revenue streams for artists.

Comparing Artist Revenue Streams

This table breaks down different income sources, highlighting their potential, the initial effort required, and how easily they can grow. Use it to figure out which streams make the most sense for you right now.

Revenue Stream | Income Potential | Initial Effort | Scalability |

|---|---|---|---|

Original Art Sales | High | High | Low |

Commissions | High | Medium | Low |

Prints & Reproductions | Medium | Medium | High |

Merchandise Licensing | Medium | Low | High |

Teaching/Workshops | Medium | High | Medium |

Digital Products | Low-Medium | High | Very High |

Patreon/Subscriptions | Varies | Medium | Medium |

As you can see, there's a trade-off between immediate high income (like original sales) and long-term scalability (like digital products). The sweet spot is finding a mix that provides both stability and growth.

Actionable Strategies for Diversification

Okay, let's get practical. Building multiple revenue streams doesn't have to be some overwhelming project. You can start small by adding just one or two new sources that feel like a natural fit for your work.

Physical and Tangible Income Streams

Direct Sales and Commissions: Keep focusing on your primary art, but get strategic. Use a simple inventory system to track what sells best—size, subject matter, price point—and let that data guide what you create next. High-value commissions offer guaranteed income, so don't be shy about seeking them out.

Merchandise and Licensing: Your art can live on more than just a canvas. Licensing your designs for products like coffee mugs, t-shirts, and phone cases can create a fantastic, steady stream of passive income. Artist Lindy Severns, for example, loves seeing fans connect with her art through something as simple as a $30 mug.

Teaching and Workshops: Your expertise is incredibly valuable. Hosting workshops, whether in-person or online, not only generates income but also builds your community and positions you as an expert in your niche.

This idea of financial diversification isn't just for visual artists; it's a major shift happening across all creative fields. The music industry is a perfect example. In 2025, the U.S. music industry's revenue hit a staggering $5.6 billion by mid-year, largely driven by paid subscriptions and various digital platforms.

Tapping into the Digital Marketplace

The online world offers incredible opportunities to expand your reach and create new income sources that simply weren't possible a decade ago. It’s your ticket to selling to a global audience, 24/7.

Digital Revenue Opportunities

Selling Prints Online: Platforms like Etsy or your own website make it incredibly easy to sell high-quality prints of your work. For many artists, this is the first and simplest step into the world of digital sales.

Digital Products: Think about creating and selling things like custom Procreate brushes, downloadable art packs, or PDF tutorials. They take some work upfront, but once they're made, you can sell them an infinite number of times with zero extra production cost.

Community Platforms: Services like Patreon allow your biggest fans to support you directly with a monthly subscription. In return, you can offer them exclusive content like behind-the-scenes videos, early access to new work, or personal Q&A sessions.

Exploring these different avenues is absolutely critical for any modern creative career. For a deeper dive into how musicians are doing this, check out our guide on the 9 ways musicians make money in 2025.

Ultimately, diversification is your best strategy for funding your next big idea and building a career with real staying power.

Creating a Budget That Actually Works for Your Creative Life

Let's be real, the word "budget" can make any creative person's skin crawl. It conjures up images of rigid spreadsheets and rules that just don’t vibe with the unpredictable flow of an artist's life.

But what if a budget wasn't a creative straitjacket? For an artist, a budget is your roadmap to freedom. It's a tool that adapts to your fluctuating income and helps you nail your biggest goals, instead of just hoping you get there.

Forget the one-size-fits-all templates. Smart artist financial management needs a budget that’s as dynamic as your career. It’s not about pinching every penny; it's about getting crystal clear on your money so it starts working for your art, not the other way around. And it all begins with one simple, non-negotiable step.

Separate Your Business and Personal Finances

Before you even think about tracking your spending, you have to draw a hard line between your art business and your personal life. Mixing them up is the fastest way to get stressed, confused, and land in a world of hurt when tax season rolls around.

Opening a separate business bank account is the single most important thing you can do. All your income—art sales, commissions, merch, you name it—goes into this account. All your business expenses—studio rent, supplies, marketing—come out of it. Simple. This one move gives you an instant, honest look at the financial health of your art career.

Think of it this way: Your art business is its own living, breathing thing with its own financial story. Keeping its money separate lets you read that story clearly so you can make smart decisions to help it grow.

This clarity is the foundation for everything else. It shows you exactly how much your business is making and what it costs to keep the lights on, which leads us to the next crucial step: actually paying yourself.

Master Your Variable Income with Smart Systems

The biggest headache for any artist is inconsistent cash flow. One month you're killing it with a huge commission, and the next, it's crickets. A budget built for a creative embraces this reality; it's designed to smooth out those wild peaks and valleys.

The secret is to pay yourself a predictable salary from your business account, even when your income is all over the place. Here's how: look at your earnings over the last six to twelve months and figure out your average monthly income. That number becomes your salary.

In months where the cash is flowing, pay yourself your set salary and leave the rest in the business account. This surplus is your buffer. In the slow months, you can still pay yourself that same steady salary by dipping into the extra cash you saved. Just like that, you’ve turned a chaotic income stream into a stable paycheck you can count on.

Applying Classic Budgeting Rules to a Creative Life

Once you’re paying yourself a consistent salary, you can bring in proven budgeting frameworks like the 50/30/20 rule to manage your personal finances. It’s a super simple but powerful way to organize your money after it leaves your business account.

Here’s how it breaks down for a creative career:

50% for Needs: This slice of your take-home pay covers the absolute must-haves. We're talking rent or mortgage, utilities, groceries, transportation, and health insurance. These are the fixed costs you have to cover every single month.

30% for Wants: This is your lifestyle fund. It’s for things like eating out, grabbing drinks with friends, entertainment, travel, and any hobbies you have outside of your main creative hustle. This is the flexible part of your budget that you can adjust as needed.

20% for Savings and Debt: This is how you build your future. This crucial 20% should be automatically funneled toward your big goals, like building an emergency fund (a lifesaver for any freelancer), paying down debt, and investing for retirement.

This isn't about restriction; it's about being intentional. By giving every dollar a job, you make sure you’re covering your bases today while actively building a secure financial future. And that frees you up to focus on what really matters: creating your best work.

Navigating Taxes and Legal Structures with Confidence

Taxes and legal structures. For most artists, those words alone are enough to cause a headache. It often feels like the most intimidating part of turning your passion into a business, buried under dense jargon and confusing rules. But getting a handle on this stuff is a non-negotiable piece of artist financial management.

This isn't just about staying out of trouble with the IRS. It's about protecting yourself, legally minimizing what you owe, and freeing up more cash to pour back into your creative work. Let’s cut through the noise and break it all down into simple, actionable steps.

Think of your legal structure as the foundation of your business. It dictates how you’re taxed, how much personal risk you’re taking on, and the kind of paperwork you'll be dealing with. For most artists just starting their journey, it boils down to two main options.

Sole Proprietor vs. LLC: What's the Difference?

Choosing the right business structure is a huge first step. It impacts everything from your tax bill to the safety of your personal assets. Each one has its own pros and cons, and the right choice really depends on where you are in your career.

1. Sole ProprietorshipThis is the default setting for any independent creator. The moment you start selling your art without registering as a specific business entity, you're automatically a sole proprietor.

How it works: You and your business are one and the same in the eyes of the law. Your business income is your personal income, plain and simple.

Pros: It’s incredibly easy and completely free to start. There’s almost no paperwork, and you just report your business income and expenses on your personal tax return using a Schedule C form.

Cons: This is the big one: you are personally liable for any business debts or lawsuits. If something goes wrong and your business gets sued, your personal assets—like your car or even your home—could be on the line.

2. Limited Liability Company (LLC)An LLC is a more formal business structure that, as the name implies, offers a powerful shield of protection. It creates a legal wall between your personal life and your business life.

How it works: Your business becomes its own separate legal entity. You can still have the income "pass-through" to your personal tax return, but your liability is limited to the business itself.

Pros: It protects your personal stuff. If the business racks up debt or faces a lawsuit, your personal finances are generally safe. It also tends to look more professional to clients, collaborators, and galleries.

Cons: It takes a bit more effort. You have to register with your state, pay a filing fee, and keep up with some basic annual paperwork.

So, when should you make the jump from a sole proprietorship to an LLC? A good rule of thumb is to seriously consider it once your art becomes a significant source of income, or when you start signing bigger contracts that naturally come with more risk.

Maximize Your Tax Deductions as an Artist

One of the biggest financial wins for any artist is learning to track tax-deductible expenses. Seriously, this is where you can save a lot of money. A deductible expense is simply a cost you can subtract from your income to lower the amount you get taxed on. The key is to keep meticulous records of everything.

Here are some common deductions that artists often miss:

Studio Costs: This includes rent for a dedicated studio space. If you work from home, you can deduct a portion of your rent or mortgage for your home studio (this is the home office deduction).

Art Supplies and Materials: Every single tube of paint, canvas, piece of software, or block of clay is a business expense. Don't forget anything!

Marketing and Promotion: This covers your website hosting, business cards, social media ads, entry fees for competitions, and the costs of building your portfolio.

Travel Expenses: Did you travel for an art fair, a gallery opening, or a workshop? You can deduct the cost of flights, hotels, and 50% of your meal costs while traveling for business.

Professional Development: Any online courses, workshops, books, or museum tickets you buy to sharpen your skills are deductible.

Making sure you account for all your income is just as important as tracking expenses. For a deeper dive into how revenue flows in creative fields, check out our guide on the complete revenue blueprint for music publishing—the principles offer valuable insights for visual artists, too.

A Simple Plan for Year-Round Tax Prep

Waiting until April to sort out a year's worth of finances is a recipe for pure stress and missed opportunities. Get ahead of the game by building these simple habits into your routine.

Track Everything Daily: Use a basic spreadsheet or accounting software to log every sale and every expense as it happens. Don't let that shoebox of receipts pile up.

Save for Taxes Quarterly: As a self-employed artist, nobody is withholding taxes for you. A smart move is to set aside 25-30% of every single payment you receive. Put it in a separate savings account so you aren't tempted to touch it. This money is for Uncle Sam.

Review Finances Monthly: Block out just one hour each month to go over your income and expenses. This simple check-in helps you stay on budget, spot trends, and catch any potential problems before they spiral.

Investing in Your Future with Savings and Retirement Plans

Let's be real: "long-term financial planning" is probably the last thing on your mind when you're deep in a creative flow. It often gets pushed aside as something to deal with "later." But building a solid savings and retirement strategy is the ultimate act of self-preservation for any artist. It's the safety net that lets you take bigger creative risks and ensures you can keep doing what you love for decades.

This isn't just about stashing cash under the mattress; it's a core part of building a sustainable career through smart artist financial management. The idea that artists are destined to be broke is a tired myth. With the right game plan, you can build a secure future that fiercely protects your creative freedom. And the first step is creating a buffer for when things go sideways.

Building Your Emergency Fund

Think of an emergency fund as your financial shock absorber. It’s a dedicated savings account holding three to six months of essential living expenses, ready to cover you during a slow season, an unexpected bill, or when a client flakes on a payment.

Without this cushion, one bad month can spiral into a full-blown crisis, forcing you to take on soul-crushing gigs just to make rent. An emergency fund is your creative insurance policy. Knowing it's there allows you to navigate the natural ups and downs of an artistic career with confidence, not fear.

Retirement Plans for the Self-Employed Artist

When you're your own boss, you don't get a neat, employer-sponsored 401(k) package. That means you're in the driver's seat for setting up your own retirement plan. Luckily, there are some fantastic options designed specifically for freelancers and creative entrepreneurs.

SEP IRA (Simplified Employee Pension): This is a go-to for its sheer simplicity. You can sock away up to 25% of your net self-employment income, which gives you a nice tax deduction now while your money grows for the long haul. It's a flexible plan that lets you contribute more in feast years and less in famine years.

Solo 401(k): This one is a little more hands-on but offers even greater flexibility. It lets you contribute as both the "employee" and the "employer," which means you can potentially save a lot more than with a SEP IRA. It's a powerful choice for artists who are consistently pulling in a higher income.

Choosing a retirement plan isn't just about saving money. It's about investing in your long-term creative autonomy. It’s you declaring that your art and your well-being are worth protecting for your entire life.

The Power of Compounding Even with Small Amounts

The most critical step? Just start. Even if it's a small amount. The magic of compounding—where your investment earnings start generating their own earnings—is the single most powerful force in building wealth over time. A small, consistent contribution today can snowball into a massive sum down the road.

Even when the market gets weird, consistent planning builds resilience. Take the global art market, for example. In 2024, total sales dipped to $57.5 billion, a 12% drop largely because the super high-end stuff slowed down. But here's the interesting part: the actual number of transactions grew by 3%, showing more action in the more accessible price ranges. You can dig into the full breakdown in the Art Basel and UBS Global Art Market Report.

This data just goes to show that even when the top of the market wobbles, the broader creative world keeps moving. Your personal financial strategy—including savings and retirement—is what ensures you can weather these big economic shifts and keep creating, no matter what the headlines say.

Using Smart Tools to Simplify Your Financial Workflow

Let's be real: managing your finances shouldn't feel like a second job that steals you away from the studio. If you're still buried in spreadsheets and paper receipts, you're not just wasting time—you're draining the creative energy that fuels your art. Smart tools can automate the boring stuff and give you the clarity you need, freeing you up to do what you actually love.

Think of artist financial management as working smarter, not harder. It's about building a simple system that tracks your money and helps you plan your next move. The right tools cut through the financial fog, giving you the data to make confident business decisions.

Financial Calculators: Your Secret Weapon

Good tools can turn those big, scary financial questions into simple, straightforward answers. Instead of just guessing what a project might cost or earn, you can make moves based on actual numbers. That's how you build a career that lasts.

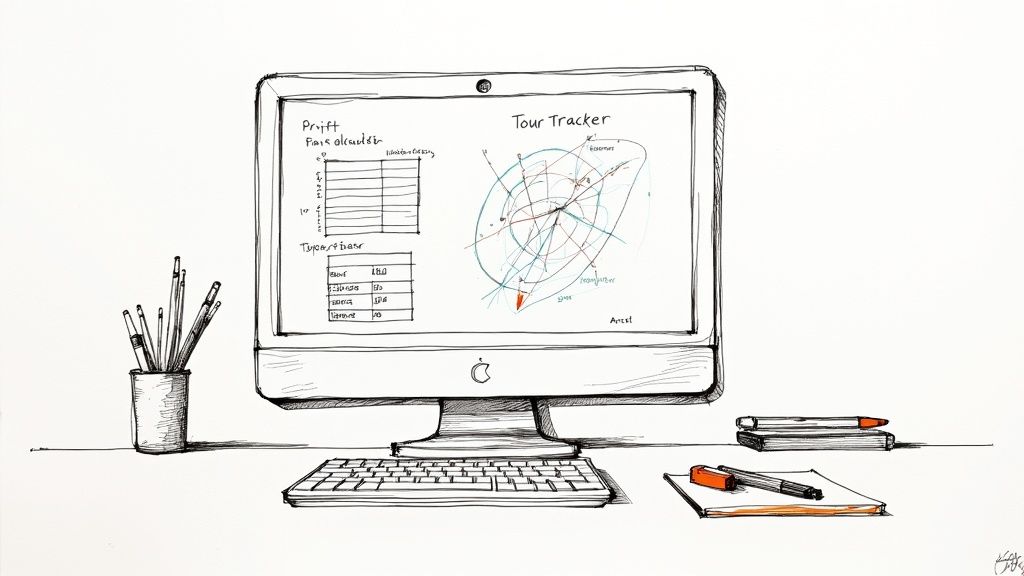

Platforms like artist.tools offer a whole suite of calculators built specifically for the kind of financial situations artists run into every day. These aren't just for crunching numbers; they're for mapping out your future.

Here’s a peek at what’s available on artist.tools:

This dashboard gives you quick access to everything from royalty estimators to playlist calculators, all designed to replace guesswork with data-driven projections. It’s all about helping you plan your next steps with confidence.

So, how does this work in the real world?

Planning a New Project: Say you're launching a limited-edition run of prints. A profit calculator lets you plug in all your costs—printing, materials, marketing, shipping—and figure out a price that actually makes you money. No more hoping for the best.

Budgeting for Shows: Got a small tour or a few gallery shows on the horizon? A tour tracker helps you lay out every single expense, from venue fees to gas money, and weigh it against what you expect to make from tickets and merch.

Forecasting Royalties: If you're a musician, understanding your streaming income is everything. You can get a much clearer picture of what to expect by using a tool like the Spotify Royalties Calculator to forecast earnings based on your stream counts.

Your Essential Software Toolkit

Beyond one-off calculations, a few pieces of software are absolutely essential for running your creative business like a pro. These tools work together to create a smooth financial workflow that can save you countless hours of admin headaches.

The goal is to build a financial "tech stack" that handles the administrative burden for you, so you can stay in your creative zone.

Here are the must-haves for your toolkit:

Accounting Software: Tools like QuickBooks Self-Employed or Wave are perfect for freelancers. They sync with your bank account to automatically sort your income and expenses, which makes tax season about a thousand times easier.

Invoicing Tools: Getting paid on time starts with looking professional. Software like FreshBooks or Bonsai lets you create slick invoices, see when they've been opened, and even send polite reminders for you. It's a game-changer for cash flow.

Inventory Management: If you sell physical art or merch, you need to know what you have. Platforms like Artwork Archive help you manage your portfolio, track every sale, and see at a glance which pieces are resonating with your audience.

Common Questions About Artist Financial Management

Even with a solid financial plan, the day-to-day reality of being a creative pro throws curveballs. Nailing these common challenges is what real artist financial management is all about. Let's break down some of the most frequent questions I hear from artists.

How Should I Price My Artwork?

Putting a price tag on your art can feel like pulling a number out of thin air, but there’s a simple formula that gives you a solid place to start.

Calculate your baseline price like this: (your desired hourly wage × hours spent on the piece) + the total cost of materials.

This grounds your price in the real value of your time and your hard costs. Once you have that number, you can tweak it based on a few other factors.

Your Experience: Artists with a longer track record and a stronger reputation can, and should, command higher prices.

The Market: Take a look at what artists with a similar style and at a similar point in their career are charging. This isn't about copying them, but about understanding where you fit in.

The Piece Itself: Is it bigger? More complex? Those things take more time and resources, which naturally means a higher price point.

Remember, your pricing isn’t set in stone. As your skills grow and demand for your work increases, don't be afraid to raise your prices to match.

What Is the Best Way to Handle Inconsistent Income?

The feast-or-famine cycle is one of the biggest sources of stress for any artist. The best way to break that cycle is to smooth out the highs and lows by paying yourself a consistent "salary" from your business account.

Start by figuring out your average monthly income over the last year. In the months you earn more than that average, park the extra cash in a separate savings account—think of it as an income stabilization fund.

This is basically you creating a personal payroll system. You're building a buffer during the good times so you can still pay yourself and your bills during the slow ones.

When you hit a leaner month, you just draw from that stabilization fund to cover your regular salary. This one simple strategy can turn a chaotic income stream into a predictable paycheck, which does wonders for your peace of mind.

When Is It Time to Hire an Accountant?

Managing your own finances is totally doable when you're starting out. But as your creative business grows, hiring an accountant becomes one of the smartest investments you can make. A good accountant who gets the creative world often saves you way more in tax deductions than their fee costs.

You should seriously consider hiring a pro when you hit these milestones:

Your annual income is consistently over $50,000.

You're thinking about forming a more official business structure, like an LLC.

You start juggling multiple, complex income streams—like international sales, licensing deals, or touring revenue.

The time you spend on bookkeeping is starting to seriously cut into the time you have to actually create.

Ready to swap guesswork for genuine insight? The suite of calculators and trackers from artist.tools gives you the financial clarity you need to build a career that lasts. Explore the tools at https://artist.tools and start making smarter decisions for your art today.

Comments