Top Music Streaming Statistics You Need to Know in 2025

- Jun 2, 2025

- 19 min read

The State of Music Streaming in 2025

Want to thrive in the music industry? You need to understand current music streaming statistics. This listicle delivers seven essential data points for artists, playlist curators, and music professionals. These figures reveal key trends impacting music consumption, revenue, and discovery in 2025. From Spotify's market share to average streaming payouts and playlist impact, this data is crucial for effective music marketing and strategic decision-making. Let's dive in.

1. Spotify Dominates Global Music Streaming Market with 31% Share

When discussing music streaming statistics, Spotify's dominance is undeniable. Holding approximately 31% of the global market share, Spotify reigns as the world's leading music streaming platform. With over 500 million monthly active users and more than 200 million premium subscribers as of 2024, its influence on the music industry is profound. This impressive market share underscores Spotify's significance not only for listeners but also for artists, playlist curators, and other music industry professionals seeking to navigate the digital landscape. Understanding Spotify's market dominance is crucial for anyone involved in the music business.

Several factors contribute to Spotify’s leading position. Its early entry into the market allowed it to establish a strong user base ahead of competitors. An aggressive expansion strategy, including launching in numerous countries and adapting to local preferences, further solidified its global reach. Moreover, Spotify’s continuous innovation, particularly in playlist curation and podcast integration, has kept it at the forefront of the evolving streaming landscape. Features like Discover Weekly and personalized playlists have revolutionized music discovery for millions, while the integration of podcasts has broadened its content offering and attracted new audiences.

Spotify boasts a catalog of over 100 million songs, providing an extensive library for listeners. Its AI-powered recommendation algorithms personalize the listening experience and drive user engagement. Features like social sharing and collaborative playlists foster a sense of community among users. The platform is also available across a wide range of devices, ensuring accessibility for listeners on desktops, mobile phones, tablets, and smart speakers.

Pros:

Largest music library available: Offers an unmatched selection of music across genres and eras.

Superior discovery algorithms: Provides highly personalized recommendations, leading to increased music discovery.

Strong social features: Facilitates connection and sharing among users.

Extensive podcast content: Integrates a vast library of podcasts, including exclusive content.

Regular feature updates: Demonstrates a commitment to innovation and improving user experience.

Cons:

Lower per-stream payouts to artists: Remains a point of contention within the music industry.

Premium subscription required for mobile control on free tier: Limits functionality for free users on mobile devices.

Limited high-fidelity audio options compared to competitors: Lags behind some competitors in offering high-resolution audio streaming.

Spotify's success is reflected in several key examples. The annual "Spotify Wrapped" campaign, which provides users with personalized summaries of their listening habits, generates immense social media buzz, consistently garnering over 60 million social shares. The Discover Weekly playlist, a personalized selection of new music based on user preferences, has facilitated the discovery of over 40 billion tracks. Spotify's exclusive podcast deal with Joe Rogan, worth over $200 million, demonstrates its commitment to investing in premium content and expanding beyond music. These examples showcase Spotify’s ability to engage users, drive cultural conversations, and shape the future of audio consumption.

Tips for Leveraging Spotify:

For Artists: Utilize Spotify for Artists analytics for detailed insights into your streaming performance, audience demographics, and playlist placements. This data is invaluable for understanding your listeners and tailoring your marketing strategies.

For Playlist Curators: Focus on creating high-quality, engaging playlists that cater to specific moods, genres, or activities. Actively promote your playlists to attract followers and increase visibility.

For All Music Professionals: Leverage the Canvas feature to add visual elements to your tracks, enhancing the listening experience and increasing engagement. Staying informed about music streaming statistics, particularly Spotify's market share and user trends, is crucial for making informed decisions in the ever-evolving music industry.

Spotify, founded by Daniel Ek and Martin Lorentzon, has fundamentally changed how we consume music. Its dominance in the music streaming market signifies its influence and importance for anyone involved in the music industry, from artists and labels to playlist curators and marketers. By understanding Spotify's features, benefits, and limitations, you can effectively navigate the platform and leverage its power to achieve your goals in the digital music landscape.

2. Music Streaming Revenue Reached $17.5 Billion in 2023

The global music streaming industry experienced remarkable growth in 2023, generating an estimated $17.5 billion in revenue. This impressive figure represents a significant 67% of the total recorded music revenue worldwide, solidifying streaming as the dominant force in the modern music landscape. This shift signifies a complete transformation from the era of physical sales and digital downloads to a streaming-first consumption model. This section will delve into the factors driving this growth, analyze the benefits and challenges of the current music streaming ecosystem, and provide actionable insights for musicians, playlist curators, and music industry professionals seeking to thrive in this digital age. Understanding these music streaming statistics is crucial for anyone involved in the music business.

The growth of music streaming isn't a sudden phenomenon; major markets have consistently seen annual growth rates exceeding 10%. This sustained expansion is fueled by several key features:

Subscription-based recurring revenue model: The bedrock of music streaming's financial success lies in the predictable revenue streams generated by subscription services. Platforms like Spotify and Apple Music offer premium tiers that provide ad-free listening, offline playback, and high-quality audio, enticing users to commit to monthly or annual payments. This model offers stability for both the streaming platforms and, indirectly, for artists and labels.

Ad-supported free tier monetization: To broaden reach and attract a wider user base, many platforms offer free, ad-supported tiers. While individual payouts per stream are minimal, the sheer volume of users engaging with these free tiers generates substantial advertising revenue. This model allows platforms to reach users who may eventually convert to paying subscribers.

Geographic expansion driving growth: Emerging markets represent a significant opportunity for the music streaming industry. As internet penetration and smartphone adoption increase in these regions, so does the potential for new subscribers, driving further revenue growth. This global scalability is a defining characteristic of the streaming model.

Premium tier upgrades increasing ARPU (Average Revenue Per User): Streaming services constantly strive to increase ARPU by incentivizing users to upgrade to premium tiers. Exclusive content, improved audio quality, and enhanced features are all levers used to drive these conversions and maximize revenue per user.

Family and student plan diversification: Recognizing the diverse needs of consumers, streaming platforms have introduced various subscription plans, including family and student discounts. These options broaden accessibility and contribute to overall subscriber growth.

The shift to a streaming-centric model offers numerous advantages:

Pros:

Predictable subscription revenue streams: Recurring subscriptions offer a more stable and predictable revenue model compared to the volatility of physical sales.

Global scalability potential: Digital distribution eliminates the geographical limitations of physical media, allowing artists and labels to reach a global audience.

Lower distribution costs than physical media: Digital distribution significantly reduces the costs associated with manufacturing, shipping, and storing physical copies of music.

Real-time consumption analytics: Streaming platforms provide detailed data on listening habits, allowing artists and labels to understand their audience and tailor their marketing strategies.

Reduced piracy compared to download era: While piracy still exists, streaming has made accessing music legally more convenient and affordable, reducing the incentive for illegal downloads.

However, the streaming landscape also presents certain challenges:

Cons:

High licensing costs to record labels: A significant portion of streaming revenue goes to record labels, leaving a smaller share for artists. The negotiation of these licensing agreements is a constant point of contention within the industry.

Intense competition driving down margins: The crowded streaming market forces platforms to compete aggressively on price and features, potentially impacting profitability.

Currency fluctuations affecting international revenue: For globally operating platforms, fluctuations in exchange rates can impact revenue generated in different markets.

Customer acquisition costs increasing: As the market matures, acquiring new subscribers becomes increasingly expensive, requiring significant investment in marketing and promotion.

Examples of the impact of music streaming revenue are evident in the financial performance of major players: Spotify reported an annual revenue of $13.2 billion in 2023, while Apple Music contributes significantly to Apple's $80+ billion services revenue. Amazon Music, bundled with the Prime subscription, enhances the value proposition of Amazon's ecosystem.

For those navigating this evolving landscape, here are some actionable tips:

Monitor ARPU trends for investment decisions: Understanding ARPU trends provides valuable insights into the financial health of streaming platforms and can inform investment strategies.

Consider geographic market penetration rates: Analyzing market penetration rates in different regions helps identify growth opportunities and tailor marketing efforts accordingly.

Track conversion rates from free to premium tiers: Optimizing the conversion funnel from free to paid subscribers is crucial for maximizing revenue.

The data supporting these music streaming statistics is widely reported and analyzed by organizations like the Recording Industry Association of America (RIAA) and the International Federation of the Phonographic Industry (IFPI), along with numerous music industry analysts. Understanding these figures and the dynamics of the streaming ecosystem is crucial for success in the modern music industry.

3. Average Streaming Payout is $0.003-0.005 Per Stream

In the digital age of music consumption, understanding music streaming statistics is crucial for artists and industry professionals alike. One of the most impactful statistics is the average streaming payout, which typically falls between $0.003 and $0.005 per stream across major platforms. This seemingly small amount has revolutionized how artists earn from their music, shifting from traditional album sales to a model built on accumulating massive quantities of streams. This begs the question: How does this system work, and what does it mean for musicians trying to make a living in the modern music landscape?

The reality is that streaming payouts are far from uniform. Factors influencing these micro-payments include the streaming platform itself, the listener's subscription type (free or premium), the artist's royalty agreement, and even the listener's geographical location. For instance, Spotify pays roughly $0.003-$0.004 per stream, while Apple Music offers a slightly higher rate of around $0.007-$0.01, and YouTube Music sits at the lower end with $0.001-$0.003 per stream. These varying rates, combined with the platform's overall revenue sharing model and the specific tier of subscription the listener has, contribute to a complex calculation that ultimately determines how much an artist earns per stream. Further complexities are introduced by geographic location; streams originating from different countries can generate varying royalty payments. This intricate web of factors emphasizes the need for artists to understand the nuances of streaming economics.

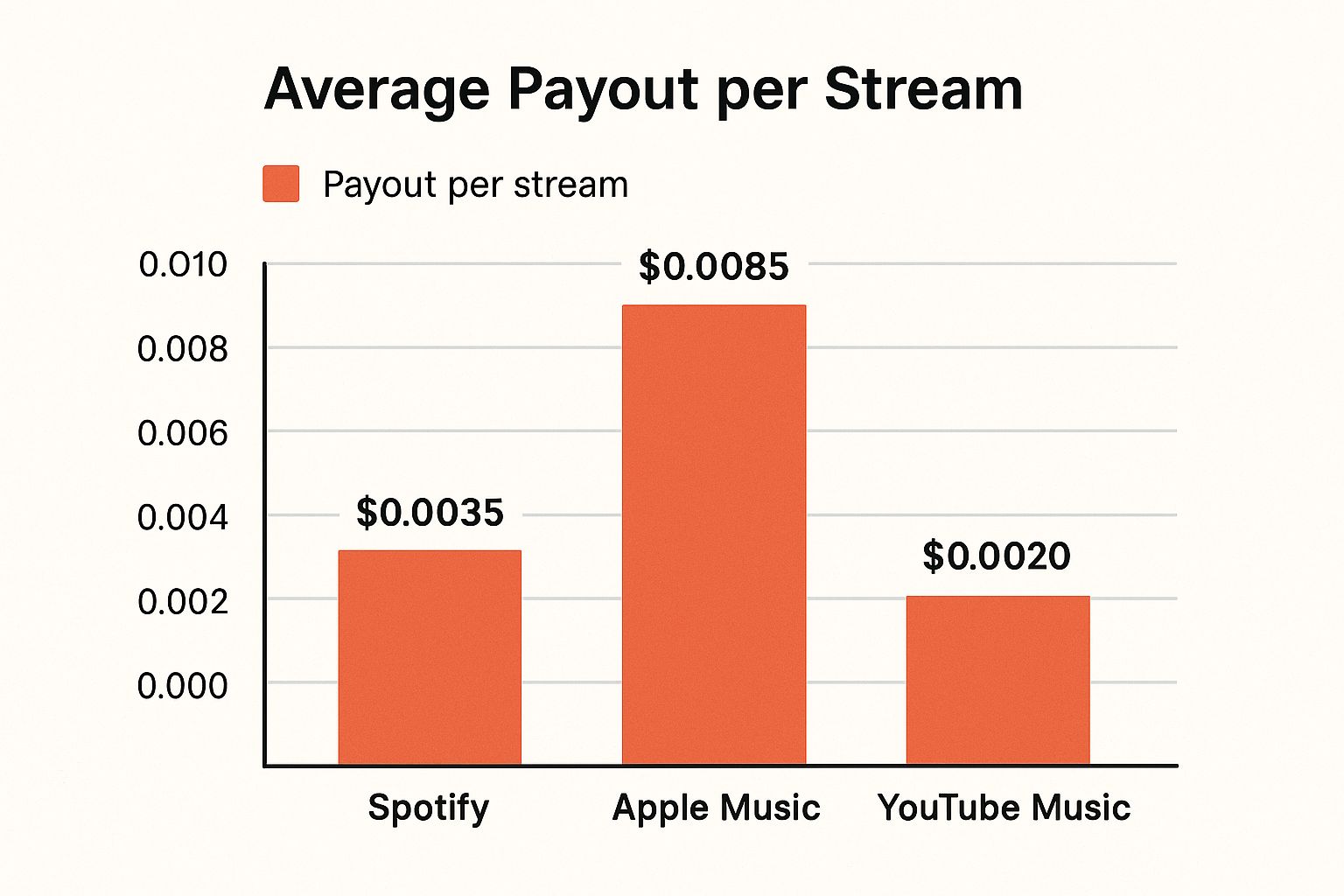

The following infographic illustrates the disparities in average payout per stream across three major platforms: Spotify, Apple Music, and YouTube Music.

As the bar chart clearly demonstrates, Apple Music offers the highest average payout per stream at $0.0085, followed by Spotify at $0.0035, and finally YouTube Music at $0.002. This visualization highlights the importance of platform strategy when aiming to maximize streaming income.

The implications of these low per-stream rates are profound. While the potential for earning is theoretically unlimited, especially with viral content reaching millions or even billions of listeners, the reality is that achieving significant income requires massive scale. To illustrate, 1 million streams on Spotify translate to approximately $3,000-$4,000. Even a global hit like Taylor Swift's 'Anti-Hero' with over a billion streams likely earned in the $3-4 million range from streaming alone. For independent artists, this translates to needing over 250,000 monthly streams just to earn the equivalent of minimum wage. Learn more about Average Streaming Payout is $0.003-0.005 Per Stream

Despite the challenges posed by low per-stream rates, streaming platforms offer undeniable advantages. They provide global reach without the need for physical distribution and real-time payment processing. The barriers to entry for new artists are significantly lower compared to traditional record deals. However, this accessibility has led to an explosion in the volume of content available, intensifying the competition for listeners and potentially favoring high-volume releases over high-quality artistry.

So, how can musicians thrive in this environment? Strategic playlist placement is critical for maximizing stream volume. Diversifying across multiple platforms helps optimize total payouts, while cultivating direct fan relationships opens doors to higher-margin revenue streams like merchandise, fan clubs, and ticketed live streams. Independent artists and labels should also consider negotiating exclusive release deals with certain platforms to potentially secure better streaming rates. These strategies, combined with a clear understanding of music streaming statistics, empower artists to navigate the complexities of the modern music industry and build sustainable careers. This knowledge is essential for anyone involved in the music business, from playlist curators to seasoned professionals, making average streaming payout a vital component in the broader landscape of music streaming statistics.

4. 83% of Music Consumption is Now Through Streaming

The music industry has undergone a seismic shift in the past decade, with streaming now dominating how people consume music. A staggering 83% of total music consumption in the United States, and similar percentages globally, occurs through streaming platforms. This statistic encompasses both audio streaming services like Spotify and Apple Music, and video platforms like YouTube Music and Vevo, reflecting a complete transformation from the physical and digital download era. The remaining 17% of music consumption is attributed to traditional physical sales (vinyl records and CDs) and digital downloads, marking the fastest format transition in music industry history.

This dominant 83% figure includes both subscription-based streaming (where users pay a recurring fee for ad-free access) and ad-supported streaming (where users listen for free but with interspersed advertisements). It’s important to understand that this number varies by demographic and geographic region. For example, Gen Z listeners stream approximately 95% of their music, demonstrating an almost complete reliance on streaming platforms. Conversely, while vinyl sales have experienced a resurgence in recent years, they still represent a small fraction (around 5%) of overall music consumption, highlighting the limited impact of the “vinyl revival” on the broader market. Furthermore, digital downloads, once a significant player, have been steadily declining by approximately 20% annually since 2018, driven by the convenience and accessibility of streaming.

The growth of music streaming continues at a robust pace of 10-15% annually, largely fueled by the mobile-first consumption pattern. Smartphones have become the primary device for music listening, making on-demand access easier than ever. This trend has significant implications for musicians, playlist curators, and music industry professionals.

For artists, the dominance of streaming presents both opportunities and challenges. The instant access to vast music catalogs provided by streaming platforms allows artists to reach a global audience. Furthermore, the relatively affordable monthly pricing for listeners, compared to purchasing individual albums or singles, makes music more accessible to a wider range of consumers. However, artists face the challenge of earning a living in a streaming-centric environment, where per-stream royalties are often low. This necessitates a focus on platform optimization, including playlist pitching, engaging with fans, and leveraging data analytics to understand listener behavior.

Record labels have also had to adapt their marketing strategies. Traditional methods of promoting physical releases are no longer as effective. Instead, they must prioritize strategies for streaming discovery, such as playlist placement, influencer marketing, and social media engagement. Understanding streaming analytics is crucial for market research and identifying emerging trends.

While streaming dominates music consumption, some artists and platforms are exploring new frontiers. Innovations like Web3 music platforms are emerging, offering potential alternatives to the current centralized streaming model, as discussed in "Why Music Needs Its Own Namespace in Web3: Key to Industry Change" from Kooky Domains.

For playlist curators, the importance of streaming is undeniable. Playlists have become a primary means of music discovery, influencing what listeners hear and shaping the success of artists. Curators need to stay attuned to listener preferences, emerging genres, and data analytics to create compelling and impactful playlists.

Here's a summary of the pros and cons of the streaming-dominated music landscape:

Pros:

Instant access to vast music catalogs

Affordable monthly pricing compared to buying albums

Discovery of new artists and genres facilitated by algorithms and curated playlists

Cross-device synchronization for seamless listening experiences

No physical storage requirements

Cons:

Requires continuous internet connectivity

Monthly subscription costs accumulate over time

Limited ownership of music content; users only have access while subscribed

Platform dependency for music access; losing access to a platform means losing access to saved music and playlists

The 83% statistic is a clear indicator of music's digital future. Understanding music streaming statistics, and how they constantly evolve, is crucial for anyone involved in the music industry, from artists and labels to playlist curators and marketers. By adapting to this changing landscape and leveraging the opportunities presented by streaming, musicians and industry professionals can thrive in the digital age.

5. Average User Streams 2.5-3 Hours of Music Daily

Music streaming has revolutionized how we consume music, and one of the most compelling music streaming statistics reveals the sheer volume of daily engagement. The average user now streams between 2.5 and 3 hours of music per day, which translates to roughly 40-60 individual tracks. This represents a staggering 40% increase in music consumption compared to the pre-streaming era, where physical albums and limited radio play dictated listening habits. This shift underscores the significant impact streaming services have had on the music industry and highlights crucial opportunities for artists and music professionals.

This dramatic rise in music consumption is fueled by several key factors inherent to the streaming model. Convenience is paramount; accessing millions of songs at the touch of a button eliminates the limitations of physical media and expands musical horizons. The ability to create personalized playlists tailored to specific moods, activities, or genres adds another layer of engagement. Furthermore, seamless integration with mobile devices and the prevalence of background listening capabilities allow music to become a constant companion throughout daily activities such as commuting, working, and exercising.

Specific usage patterns further illuminate this trend. Commute hours, typically between 7-9 AM and 5-7 PM, witness higher engagement as individuals use music to enhance their journeys. Background listening while working is also prevalent, with many finding that music improves focus and productivity. Weekends see usage spikes, reflecting the role of music in leisure activities and social gatherings. Data also indicates that mobile listening dominates, accounting for approximately 75% of total streams. Finally, the shift towards playlist-based consumption, often curated by algorithms or influencers, has overtaken traditional album listening, further fragmenting listening habits and creating new pathways for music discovery.

The implications of this increased engagement are multifaceted. For listeners, the pros include vastly expanded music discovery opportunities, the ability to curate personalized soundtracks for daily life, enhanced mood regulation through readily available music, and even improved productivity with background listening. However, there are also potential downsides. The constant presence of music can lead to it becoming background noise, potentially diminishing deep listening and album appreciation. High mobile data consumption can strain data plans, and the sheer volume of available music can contribute to attention fragmentation across many artists, making it harder for individual musicians to stand out.

Several examples illustrate the scale of daily music streaming. Spotify users globally average a combined 25 billion listening hours monthly. Apple Music users, on average, stream approximately 18 hours of music weekly. The popularity of workout playlists often leads to average session lengths of 45 minutes or more, further highlighting the integration of music into specific activities. Learn more about Average User Streams 2.5-3 Hours of Music Daily

For musicians, playlist curators, and music industry professionals, understanding these music streaming statistics is crucial for success. Artists should focus on creating playlist-optimized content, ensuring their music fits seamlessly into curated listening experiences. Strategic release scheduling should consider peak listening times to maximize exposure. Developing content suitable for both background and active listening caters to diverse consumption habits. Optimizing music and promotional materials for the mobile listening experience is essential, given its dominance in the market.

Understanding and leveraging these insights is no longer optional but rather a necessity in the modern music landscape. The average user streaming 2.5-3 hours of music daily signifies a fundamental shift in music consumption, presenting both challenges and unprecedented opportunities for those operating within the music industry. By adapting to these trends and incorporating these music streaming statistics into their strategies, artists and music professionals can effectively reach their target audience and thrive in the streaming era.

6. Playlist Placements Drive 31% of New Music Discovery

In the ever-evolving landscape of music streaming statistics, playlist placements have emerged as a dominant force, accounting for 31% of how users discover new music. This makes them the single most important discovery mechanism in the streaming era, surpassing even traditional radio airplay. This statistic highlights the crucial role playlists play in connecting artists with new audiences and shaping the future of music consumption. Understanding this powerful tool is essential for musicians, playlist curators, and anyone involved in the music industry. But how exactly do playlists contribute to this significant percentage of music discovery, and what are the implications for artists and listeners alike?

Playlist placements can be broadly categorized into three key types: editorial, algorithmic, and user-generated. Editorial playlists are curated by platform staff at streaming services like Spotify and Apple Music, offering a blend of popular tracks and emerging artists. Examples include Spotify's behemoth "Today's Top Hits," boasting over 30 million followers, and Apple Music's "New Music Daily," which highlights fresh releases. These playlists, often featuring prominently on platform homepages, can generate millions of streams for included tracks, providing unparalleled exposure.

Algorithmic playlists, on the other hand, leverage the power of user data and listening history to generate personalized recommendations. Spotify's "Discover Weekly," a prime example, introduces users to a curated selection of new tracks each week, collectively responsible for over 2 billion new track discoveries annually. This data-driven approach offers a unique opportunity for artists to reach listeners with similar musical tastes, fostering a deeper connection and potentially converting casual listeners into dedicated fans.

Finally, user-generated playlists, created and shared by individual listeners, contribute to the social aspect of music discovery. These playlists, often organized around specific genres, moods, or activities, offer a more personalized and community-driven approach to music curation. While their individual reach might be smaller than major editorial playlists, the sheer volume of user-generated playlists contributes significantly to the overall music discovery ecosystem.

The rise of playlist placements has democratized music discovery, bypassing traditional gatekeepers like radio DJs and record labels. Artists from all backgrounds, including independent and international acts, now have the potential to reach a global audience based on the merit of their music. This has led to increased exposure for diverse genres and artists who might have previously struggled to gain traction in the traditional music industry. Furthermore, personalized recommendations from algorithmic playlists refine over time, leading to more relevant and engaging music discovery experiences for listeners. The reduced effort required for music curation, thanks to pre-made playlists, also appeals to the modern listener, further solidifying playlists as a primary source of music consumption.

However, this reliance on playlists also presents certain challenges. Algorithm bias, for example, can potentially limit discovery by favoring established artists or specific genres, inadvertently creating echo chambers and hindering the exposure of truly unique and emerging talent. Playlist fatigue, a consequence of over-curation, can lead to listeners feeling overwhelmed by the sheer volume of music available and ultimately disengaging from the discovery process. Furthermore, the reliance on playlists can inadvertently reduce the element of serendipitous discovery that once characterized browsing record stores or tuning into late-night radio. Finally, this system creates a platform dependency for music exposure, placing significant power in the hands of streaming services.

For musicians aiming to leverage the power of playlists, several actionable strategies can be employed. Pitching new releases to playlist curators 2-4 weeks before the official release date is crucial, allowing them ample time to consider inclusion. Optimizing metadata and genres for algorithmic inclusion ensures that tracks are correctly categorized and more likely to appear in relevant algorithmic playlists. Building relationships with independent playlist curators, often tastemakers within specific niche genres, can also significantly boost exposure. Finally, crafting compelling artist stories and engaging with fans on social media can increase the likelihood of editorial consideration.

The success stories are plentiful. Billie Eilish, for instance, gained significant early traction through playlist placements before achieving mainstream success. Similarly, the proliferation of lo-fi hip-hop playlists has generated hundreds of millions of monthly streams for artists within that genre, demonstrating the potent impact of curated listening experiences. In the world of music streaming statistics, playlist placements aren't just a trend; they are a fundamental shift in how music is discovered, consumed, and ultimately, how artists build their careers. Understanding and effectively utilizing this dynamic landscape is essential for anyone seeking to thrive in the modern music industry.

7. Mobile Devices Account for 75% of All Music Streaming

The dominance of mobile devices in music streaming has reshaped the entire industry. A staggering 75% of all music streaming activity originates from mobile platforms, a statistic that underscores the importance of mobile-first strategies for artists, playlist curators, and music industry professionals. This mobile-centric listening behavior has fundamentally altered how music is consumed, discovered, and shared, impacting everything from user interface design and feature development to content creation and marketing strategies. Within this mobile dominance, smartphones hold the lion's share, generating 60% of streaming activity, while tablets contribute the remaining 15%. This leaves desktop computers and smart speakers/connected devices to account for the remaining 25% of the market, split 15% and 10% respectively.

This mobile-first consumption pattern is driven by the ubiquity of smartphones and the convenience they offer. Music streaming apps, optimized for mobile use, provide on-the-go access to vast music libraries. Features like offline downloads address data management concerns, while integration with mobile ecosystems (Siri, Google Assistant) allows for seamless voice control and hands-free listening. Location-based recommendations and features, along with social sharing integrations within mobile apps, further enhance the personalized and connected listening experience.

The benefits of mobile streaming are clear. Users enjoy unparalleled access to music anywhere with cellular or WiFi connectivity, integrating music seamlessly into their daily activities. The personal listening experience offered by headphones and the ability to transition smoothly between activities and locations are key drivers of mobile adoption. Examples of this mobile dominance are evident in Spotify’s mobile app downloads exceeding 1 billion globally, and the pre-installation of Apple Music on iOS devices, a factor contributing to a reported 40% higher iOS adoption among music lovers. Furthermore, platforms like TikTok, with their seamless mobile integration, have become powerful drivers of music discovery, particularly for Gen Z.

However, the mobile-first landscape also presents challenges. Higher data consumption can strain mobile data plans, and continuous streaming significantly impacts battery life. Audio quality limitations inherent in mobile speakers are another drawback, and smaller screen sizes can constrain the development of complex user interfaces within mobile apps.

For musicians, playlist curators, and music industry professionals, understanding and adapting to this mobile-centric reality is crucial. Prioritizing mobile app user experience optimization is paramount. This includes developing mobile-specific features like voice control and intuitive navigation. Considering data usage optimization is especially important for targeting users in emerging markets, where data costs can be prohibitive. Integrating with mobile payment systems streamlines subscription processes and enhances user convenience.

When and why should you prioritize a mobile-first approach? The answer is unequivocally "now" and "because the majority of your audience is already there." For musicians marketing on Spotify, ensuring your music is easily discoverable and shareable on the mobile app is essential. Playlist curators need to understand mobile listening habits to craft playlists that resonate with on-the-go listeners. Music industry professionals must recognize the influence of mobile platforms on trends and consumption patterns to make informed decisions about artist development, marketing campaigns, and overall strategy.

In conclusion, the dominance of mobile in music streaming represents not just a shift in consumption habits, but a fundamental change in how the music industry operates. Embracing this mobile-first reality and adapting strategies accordingly is no longer optional, it’s a necessity for success in the modern music landscape.

7 Key Music Streaming Stats Comparison

Aspect | Spotify Dominance ⭐📊 | Streaming Revenue Growth ⭐📊 | Avg. Payout Per Stream ⭐📊 | Streaming Consumption Share ⭐📊 | Avg. User Daily Streaming ⭐⚡📊 | Mobile Streaming Share ⭐⚡📊 |

|---|---|---|---|---|---|---|

🔄 Implementation Complexity | Moderate: Requires platform innovation & curation | Moderate: Subscription and ad-supported revenue models | Low: Defined payout mechanism by platforms | Low: Industry-wide shift to streaming formats | Low: Passive user engagement increase | Moderate: Mobile app optimization and integration |

💡 Resource Requirements | High: Large catalog, AI, podcast rights | High: Licensing, infrastructure, and marketing | Low to Moderate: Payout processing systems | Medium: Platform and user adoption | Moderate: Data analytics and user engagement tools | Moderate: Mobile device development and support |

⭐ Expected Outcomes | Market leadership, brand dominance, user growth | Rapid revenue growth, industry transformation | Micro-payments to artists, incentivizing scale | Majority consumption channel, industry standard | Higher daily engagement and music discovery | Majority of streams from mobile, user convenience |

💡 Ideal Use Cases | Music discovery, social sharing, podcast delivery | Monetization strategies, investor insights | Artist revenue modeling, royalty distribution | Market research, strategic planning | User experience design, content scheduling | Mobile-first app design, emerging market focus |

⚡ Key Advantages | Large library, innovative algorithms, social features | Predictable recurring revenue, global scalability | Real-time payments, global reach | Fastest industry format transition | Increased engagement, background listening | On-the-go access, integration with mobile ecosystem |

Leveraging Music Streaming Statistics with artist.tools

From Spotify's market dominance and the impressive growth of streaming revenue to the crucial role of playlists in music discovery, understanding music streaming statistics is essential for success in today's music industry. Key takeaways include the significant revenue generated through streaming ($17.5 billion in 2023), the reliance on mobile devices for consumption (75%), and the power of playlists in driving new music discovery (31%). Internalizing these trends and recognizing the average payout per stream ($0.003-$0.005) and daily listening habits (2.5-3 hours) provides crucial context for artists and professionals alike.

Mastering these concepts isn't just about knowing the numbers; it's about leveraging them to your advantage. By understanding the dynamics of the streaming landscape, you can make informed decisions about your release strategy, playlist targeting, and overall marketing efforts. This empowers you to optimize your reach, connect with a wider audience, and ultimately, achieve your career goals within a data-driven environment.

The future of music is digital, and success hinges on strategic data analysis. To effectively navigate this evolving landscape and maximize your potential, you need access to the right tools. Ready to turn these music streaming statistics into actionable insights? Visit artist.tools today and discover how our platform can empower you to analyze playlist performance, detect bot activity, track your streams, and gain a competitive edge in the music industry.

These numbers clearly reflect the Granny Game direction of the music industry in 2025 — data-driven and mobile-first. With 75% of users listening to music on their phones, optimizing the mobile experience is vital for every artist and music label. This article sums it up extremely accurately!